Melbourne house prices are proving to be stable even in the midst of the pandemic. But it’s not without rhyme or reason that, while other sectors and even other property markets across Australia have declined, Melbourne house prices are holding.

Property market experts explained that the low sales volumes and the government support to both business and individuals have been effective in keeping the values steady.

Sales volumes have been down by about 40% year-on-year though more Melbourne properties are expected to be on offer for sale later. As well, the government financial support will not go on forever. Not discounting these facts, however, experts believe that Melbourne house prices may fall but will surpass expectations at this time of COVID-19.

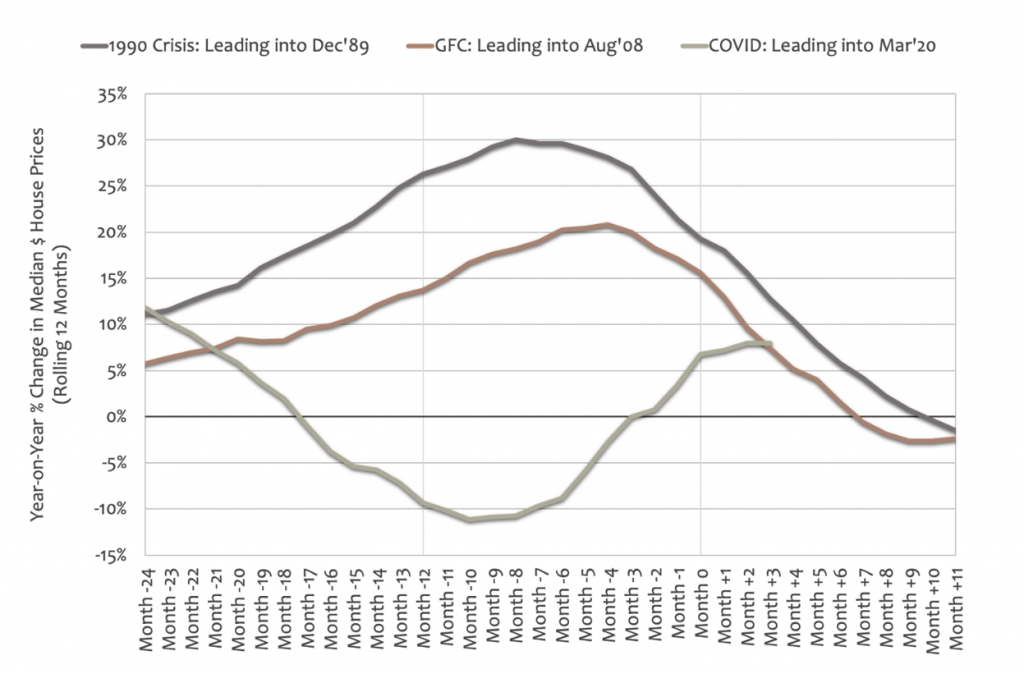

Historically, Melbourne’s property market has suffered through cyclical economic conditions. During the 1990 unemployment crisis, values fell by about 8%. Similarly, during the Global Financial Crisis in 2008, Melbourne house values took a downward hit by 3 to 4%.

Take a look at the graph below:

The figures will show us that leading to both the 1990 and 2008 crises, Melbourne house prices have begun to rise.

In comparison, before COVID-19 hit, house values in Melbourne have just started to show a recovery. House prices are not inflated, resulting in a relatively stable market with changing economic conditions not quite compounding impacts of COVID-19.

This suggests that if COVID-19 did not happen, Melbourne would enjoy a very strong property market today.

Today, with COVID-19 holding the economy and nearly every business in Australia hostage, experts still look forward to potentially long-term growth in the Melbourne property market. There is hope that though house values may likely fall soon, Melbourne house prices will quickly recover as soon as life returns to normal.

If you need more info or you require the assistance of qualified accountants in Melbourne, get in touch with us. We’d be happy to help.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.

Although every effort has been made to verify the accuracy of the information contained on this page and on this website, Chan & Naylor, its officers, representatives, employees, and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.